Estimating retirement expenses

For example the national average cost 2 for an in-home health aide in 2021 was 61776 whereas a private room in a nursing home facility was 108405. Several credit card companies offer a yearly summary to make this step easier.

Retirement Withdrawal Calculator For Excel

And youll likely find huge opportunities for cutting costs.

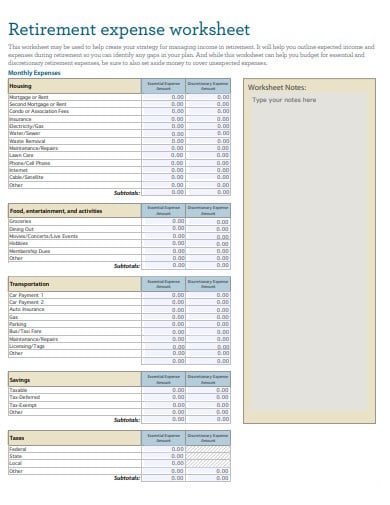

. Use this interactive worksheet to help you estimate your monthly retirement expenses. Using annual leave voluntary separation andor bonus pay to contribute to Deferred Comp. The advantages of leaving your money in Deferred Comp upon separation of service or retirement.

But estimating these can get difficult. Starting at age 55 spending tends to increase slightly as some younger retirees travel or take on new. Develop a good record-keeping system for your business.

Go to PGEWork For Me About Me Learning My Learning Smart Search. While accurately estimating your expenses for the rest of your life is a daunting prospect the right tools and advice can make it easy. In the search field type the.

How your spending habits change in retirement. Consider using an expense app to keep tabs on receipts charitable donations and other deductible expenses. These details help in understanding the family status and design the plan accordingly.

The AARP Retirement Income Calculator estimates how much youre projected to have by a target retirement date and estimates the minimum amount youll likely needIt shows results in terms of yearly cash flow streams. Youll have important bills and expenses to pay in retirement. Estimating when you can retire.

Service Retirement Benefit Estimate Calculators Defined Benefit Plan. Good scoring 26 out of 3 Scorecard Components. Medical expenses during the age of retirement can be expensive.

To find out if your retirement income will be enough you have to start by estimating your retirement expenses. Retirement is as easy as 1-2-3. Download Estimating RMSA Account Balance and Retiree Medical.

Credit for increasing research activities Form 6765. Economists have focused on some of the problems. Retiree Medical and Other Expenses.

The ability to add Social. For an overview of what you need to do to start the retirement process check out these resources. The Inflation Reduction Act attempts to raise hundreds of billions of dollars from corporations without raising the corporate tax rate through a 15 percent book minimum tax a new alternative minimum tax applied to the financial statement income ie book income that companies report to their investors.

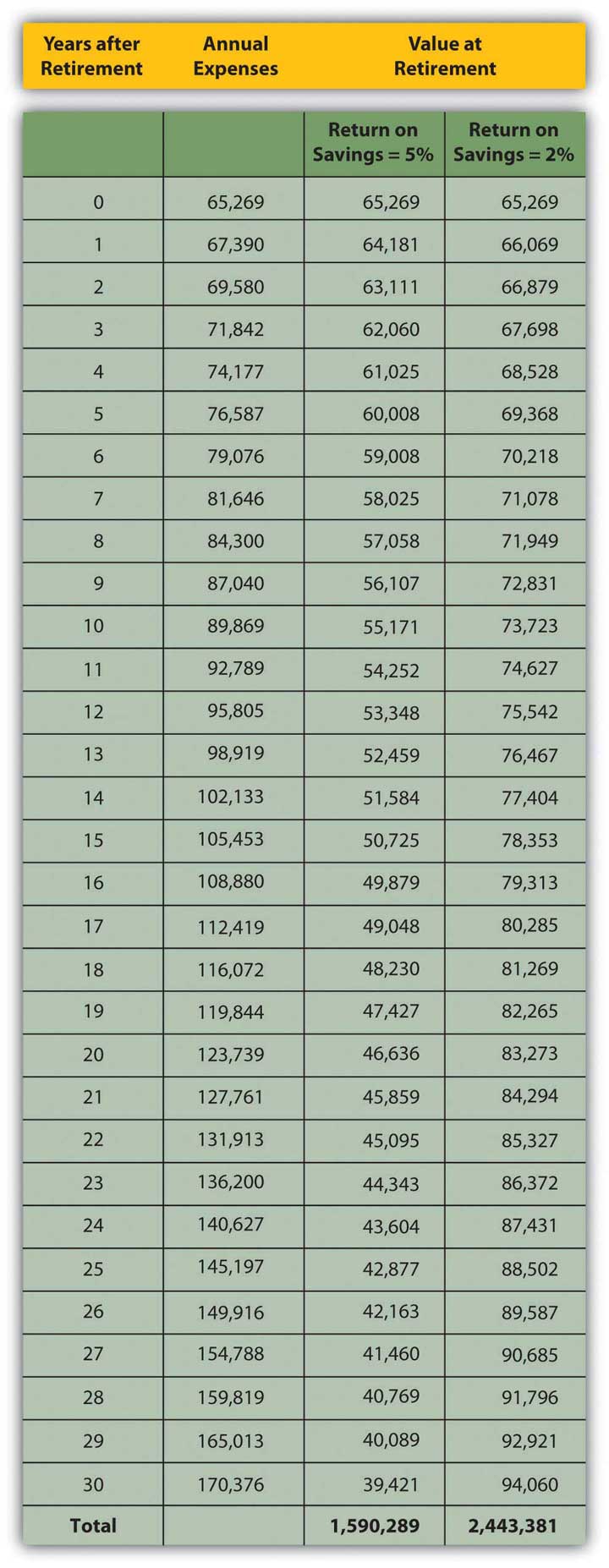

But the entire 10000 is available as cash flow you can use to cover expenses. One time investment. The feasibility of pending retirement by analyzing all projected income sources against expenses and the future cost of living.

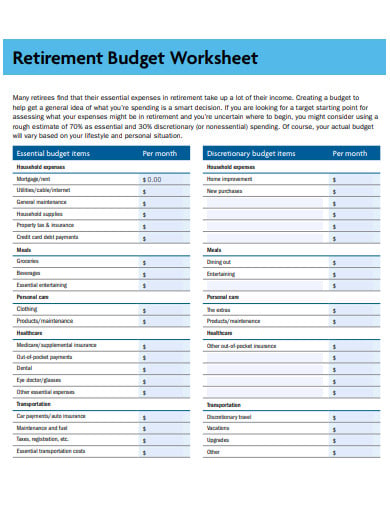

Have a contingency fund for retirement. 2 On average US households under age 55 spend almost 58000 a year on a wide variety of expenses. Worksheet that can help you determine your retirement expenses and create a realistic budget based on your retirement income.

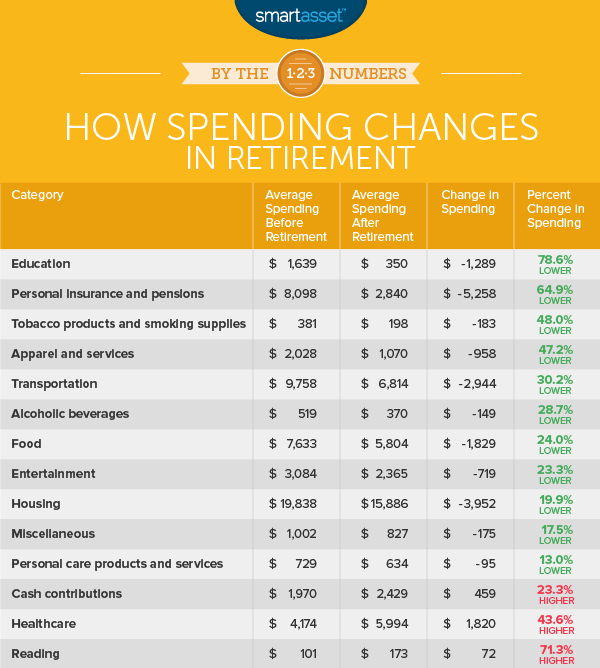

When the Employee Benefit Research Institute analyzed the spending patterns of older Americans they found that out-of-pocket healthcare spending rose with age while transportation clothing and entertainment spending all. Retirement housing costs should be a key consideration in your overall financial plan. Inflation adjusted expense per annum at retirement.

7 Smart Ways to Secure Guaranteed Retirement Income. When you receive your 1099 forms be sure to check them for accuracy. Multiplying your expenses in retirement by 25 to determine the total amount of retirement money you need is linked to another rule of thumb called the 4.

Whether you spend 30000 on home modifications to age in place or 300000 on housing in a retirement community its essential to take a hard look at the different options and the related expenses. You can retire in 124 years with a savings rate of 60 annual expenses 20000 annual savings 30000 monthly expenses 1667 monthly savings 2500 When your annual return on investments cover 100 of your expenses you are financially independent. This credit applies to the qualified expenses you paid for employee childcare and qualified expenses you paid for childcare resource and referral services.

Use this guide to determine how types of retirement income are taxed so you can plan accordingly. 3 Liquidity and Diversification Strategies for Small Business Owners. Create a List of Your.

This need not include child educational expenses or EMIs as the investor might not incur this after retirement. Under the Defined Benefit Plan your retirement income is determined by a calculation that uses your age at retirement years of service credit and final average salary FAS the average of your five highest salary yearsYou are eligible for a retirement benefit upon meeting age and years of. Your expenses are likely to change over the course of retirement with leisure spending decreasing over time Storey notes.

You will have to know where you stand before making a proper budget planTake out your checkbook as well as your credit card statements to access your records for the past years. High scoring 3 out of 3. Make sure you have accurate records of both your income and expenses for the year.

As people age their spending patterns change according to an analysis of Bureau of Labor Department data. Department of Health and Human Services estimates that close to 70 of todays 65- year-olds will require some kind of long-term care for an average of about three years and the costs are high and rising. IEG offers sponsorship consulting and valuation and provides industry leadership through its annual conference publications etc.

Corpus needed on retirement. What Income Is Taxable. To estimate your income needs in retirement My Retirement Plan multiplies your estimated income at retirement by your income replacement.

Here are five ways you can help yourself accurately track yours. Estimating expenses as you plan for retirement can be tricky. For more information see Form 8882.

Estimating Your Taxes in Retirement. Having a contingency fund for medical expenses is a must during retirement. Projecting your retirement spending is a good way to determine how much savings you really need to fund your retirement.

My Retirement Plan begins by estimating your income at retirement and then uses government data and information you provide eg education level current income retirement age to project your annual income year over year. Collect Your Financial Records. Personal details such as marital status dependents city of residence habits are also captured in estimating the retirement corpus.

Five Retirement Housing Options to Explore. Key Takeaways To know if youll have enough income in retirement start by. 5 Steps to Create a Retirement Budget Worksheet Step 1.

Estimating your retirement income.

Estimate Retirement Expenses Healthcare Will Shock You Simplestepsmax

Retirement Planning A Comprehensive Guide About How To Do It Calculator Getmoneyrich

Typical Retirement Expenses To Prepare For Sofi

Retirement Planning Projecting Needs

Free Retirement Budget Planner Template For Excel

How To Determine The Amount Of Income You Will Need At Retirement T Rowe Price

11 Retirement Budget Worksheet Templates In Pdf Doc Free Premium Templates

Retirement Budget Calculator Do I Have Enough To Retire

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

The Average Spending Amount In Retirement Is Surprisingly High

Grab This Incredible Personal Finance Excel Expense Tracker Personal Financial Planning Personal Finance Investing For Retirement

Fire Calculator When Can I Retire Early Engaging Data

11 Retirement Budget Worksheet Templates In Pdf Doc Free Premium Templates

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

The 10 Best Retirement Calculators Newretirement

How Spending Changes In Retirement Smartasset

Retirement Savings Calculator